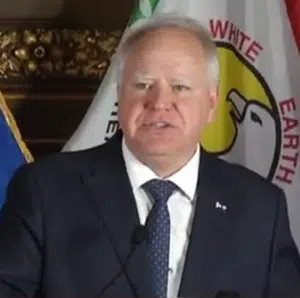

(KNOX) – Minnesota Governor Tim Walz says new figures released by the Minnesota Department of Revenue show the nation-leading Child Tax Credit has put more than $545 million into the budgets of more than 215,000 Minnesota families this year.

(KNOX) – Minnesota Governor Tim Walz says new figures released by the Minnesota Department of Revenue show the nation-leading Child Tax Credit has put more than $545 million into the budgets of more than 215,000 Minnesota families this year.

With the majority of 2023 individual income tax returns processed, the department reports that more than 437,000 eligible children benefitted with an average total credit of $1,244 per child.

Walz says “Minnesota is setting an example for the nation of how to lift families up and cut child poverty.”

Lieutenant Governor Peggy Flanagan calls the historic tax credit a game changer for Minnesota families. This credit will help Minnesotans afford groceries, rent, or a new backpack for school.”

Beginning with tax year 2023, taxpayers may qualify for a Child Tax Credit of $1,750 per qualifying child, with no limit on the number of children claimed.

This is a refundable credit, meaning they can receive a refund even if they do not owe tax. They must file an individual income tax return in order to claim the credit.